As a rollercoaster August for the markets draws to a close with what looks to be a monthly loss for the S&P 500 Index, we look at what clues seasonality data may give us for stock market performance during September and the rest of 2023. Turns out that while October may be the month that contains Halloween, September has been the scariest month for stocks looking back over the past five and 20-year periods, as well as all periods back to 1950. The good news is that in all those time periods stocks have also on average bounced back with a much stronger October.

August finishing in the red will break a five-month winning streak for the S&P 500, the longest such run since we saw seven up months in a row from February to August 2021 that was broken itself by a scary September 4.8% pullback. These strong spring to summer upticks have gone some way to dispelling the “Sell in May and go away” stock market cliché (as we explored earlier this year here), but September has been doing its best to restore credibility to this adage with the last three Septembers all down, with an average decline of 6% during the month. Dragged down by the poor September showing for stocks, the August-September timeframe has also been the weakest two-month period for stocks over all time periods since 1950 and the last five, 10, and 20 year periods.

The good news is that historically stocks have rebounded from a weak September with a fairly strong October. In fact, the October-November two-month period is the strongest of all the monthly pairings over the past five and 10 years and is second strongest over 20 years and all periods back to 1950.

Taking a look at this from a slightly different angle, based on the proportion of positive S&P 500 monthly gains (going back to 1950), September doesn’t fare any better – it has been by far the weakest month of the year. Only 44% of the 73 Septembers since 1950 have ended in the green, with February having the next fewest at just over 55%. October’s value at 61% positive is much closer to the long-term average of all months, before the strong seasonals of November and December come into play.

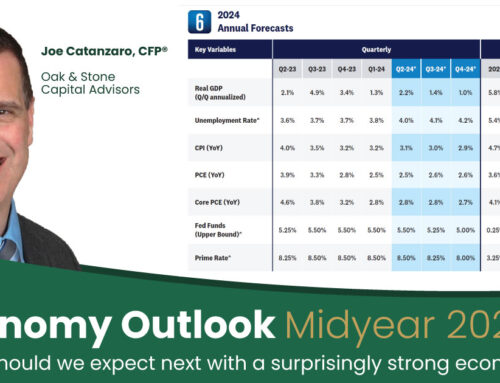

While the immediate monthly seasonal outlook is mixed, we are in the midst of the portion of the election cycle that has exhibited the most favorable historic longer-term trends for stocks. So far, this cycle has played out pretty typically. Under new presidents, markets historically struggled in the second year coming into the midterms, as they did last year, before seeing strong returns in the second half of the presidential cycle, a trend which is continuing so far this year. The good news is that the 17.5% year-to-date return for the S&P 500 has not yet hit the average for year three of a new president’s term (20.1%), and that the final year of a new president’s first term has also been above average historically.

Another positive trend from the current stage of the presidential cycle that looks as though it is almost certain to continue is that looking at returns a year out from the midterm election every time since 1950 stocks have had a positive return. The return since the November 2022 midterm has already bettered the average (14.7%), with an almost 18% increase since Election Day. If that gain holds, it will be the best post-midterm year for the S&P 500 since 1998.

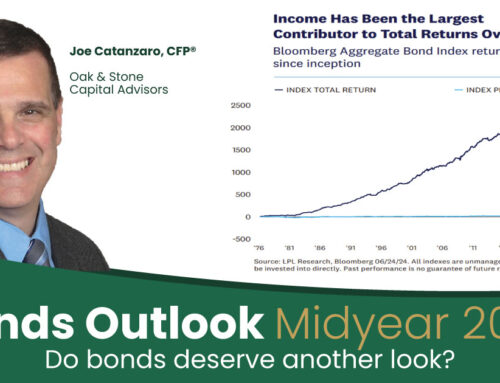

In summary, the immediate seasonal setup for September is weak, but longer-term data around the stage of the presidential cycle is more positive, as are the stronger returns that the final quarter of the year often bring. This mixed short-term outlook maintains support for our slight preference for fixed income over equities in our recommended tactical asset allocation (TAA) as fixed income valuations remain relatively favorable to equities (as exhibited by the negative equity risk premium that we wrote about here yesterday). We continue to see this as a reason to temper enthusiasm for equities, but not to be bearish, remaining neutral equities. We source the slight fixed income overweight from cash, relative to appropriate benchmarks.