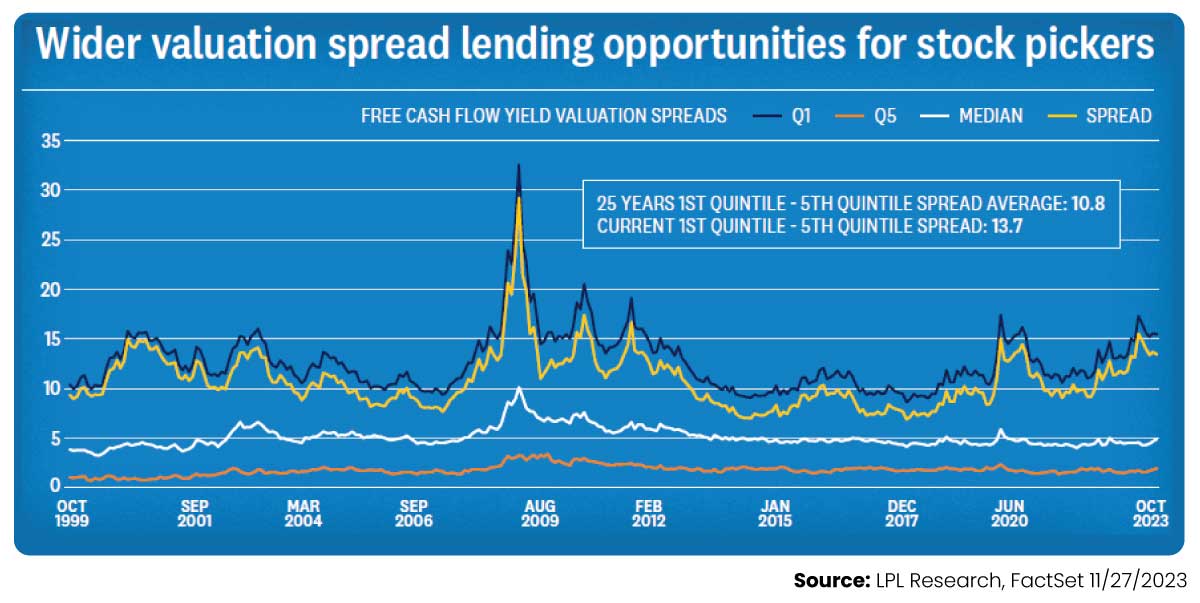

After the strong recovery of the stock market this year and the continued rise of short-term yields, markets have started to calibrate, moving toward markets of greater dispersion (an increasing gap between best and worst performing economies and assets) and volatility, which is brought about by a few factors. These include a continued decoupling of the global economy and policy actions, a well-anticipated slowdown in economic activity, and a rise in geopolitical risks. All of this adds up to an environment that’s potentially favorable for strategies that are nimble, can generate excess returns from both topdown macroeconomic forecasts as well as bottom-up fundamental analysis, have limited market sensitivity, and can take advantage of increased volatility. It’s also time for a deeper look into each manager’s investment approach. We anticipate that risk management can pay off as a greater range of performance within each strategy is expected. Staying responsive to market nuances will be key.

Among hedge fund strategies, we maintain a positive outlook on global macro strategies that can capitalize on the macro dispersion across the regions and tend to benefit from higher volatility. We also expect managed futures to continue to serve as a diversifier for portfolios that are mainly comprised of stocks and bonds. In addition, we believe bottom-up, fundamental-focused strategies that can limit market risk (both in stocks and bonds) now have a richer trading environment where they can generate excess returns from both the long and short sides of their portfolios amid rising dispersion in company fundamentals. Lastly, we continue to monitor distressed/special situation strategies, as we observe the high interest costs seeping into companies’ fundamentals and a pickup in corporate downgrades.

While we are positive on these strategies, it is important to monitor the potential risk of economic, political, and geopolitical surprises, position concentration, and the impact of leverage usage that could affect performance. Among private market strategies, we expect private credit and infrastructure to continue to show their resilience as both strategies have long-term economic trends in their favor. For private credit, strong demand from borrowers and high base rates makes current vintages quite attractive. That said, we are mindful of the potential stress that high borrowing costs could place on businesses and the overall sector.

Given sufficient yields on high-quality loans, we favor portfolios that are focused on senior secured loans with low leverage. Within private credit, we also favor portfolios with flexible and broader mandates that can diversify their positions beyond direct lending and participate in unique opportunities, such as distressed or special situations. In addition, we see compelling opportunities in the secondary markets where managers can find better supply/ demand balance and narrow the bid/ask spread. This is a positive signal for both sellers looking for liquidity and buyers looking to capitalize on discounted pricing in beaten-down sectors.

Thanks for tuning in to our 2024 Outlook!