Commodities Outlook: Global Slowdown Concerns And Prospects For Recovery

As the possibility for China’s reopening finally became a reality, analysts cautioned that the demand for industrial metals from the world’s second largest economy would help ignite a bout of inflation. Initially there was a delay in economic activity, as COVID-19 cases escalated once Beijing authorities lifted strict testing and lockdown measures. And as outlined by Communist Party leadership at the National People’s Congress (NPC) in early March, the target for 2023 economic growth would be “around 5%.” That target is less than what analysts had projected, and predicated on personal consumption since there was no indication of large infrastructure projects requiring industrial metals on a large scale.

In terms of China’s long established requirements for crude oil and crude oil products, as the world’s largest importer of oil, projections for crude oil prices were lifted as expectations that domestic and international travel, and manufacturing activity, would pick up markedly.

But concerns that the global economy was nearing the cusp of a downturn placed significant pressure on oil prices, despite a significant cut in production by OPEC+. According to OPEC+ officials, they will continue to monitor prices and adjust production based on demand, with analysts forecasting further production cuts if greater demand doesn’t materialize.

Still, the pace of economic growth in China is projected to gain momentum in the second half of 2023, and demand for a broad swath of commodities is expected to improve.

With global central banks continuing to raise interest rates, prospects for an expansion in global economic activity have abated, but forecasts suggest that by the fall of 2023, most central banks will be close to finishing their respective rate hike cycles.

INDUSTRIAL AND PRECIOUS METALS PRICE EXPECTATIONS

Prices for copper and iron ore, two key industrial metals closely associated with electric vehicle production and a strong industrial base, remain weak, but analysts expect that as the global economy shifts towards growth, these commodities will be in high demand. Moreover, there is a shortage of copper, as well as other industrial commodities, as mining activity has been slow to add additional capacity.

With the U.S. dollar easing as the Fed appears to be at, or close to, its terminal rate, commodities priced in dollars should be given a boost. And, if the Fed begins to cut interest rates to help mitigate an economic downdraft, economic activity should begin to rebound even at the margin, which should also help support commodity prices, including industrial metals and crude oil.

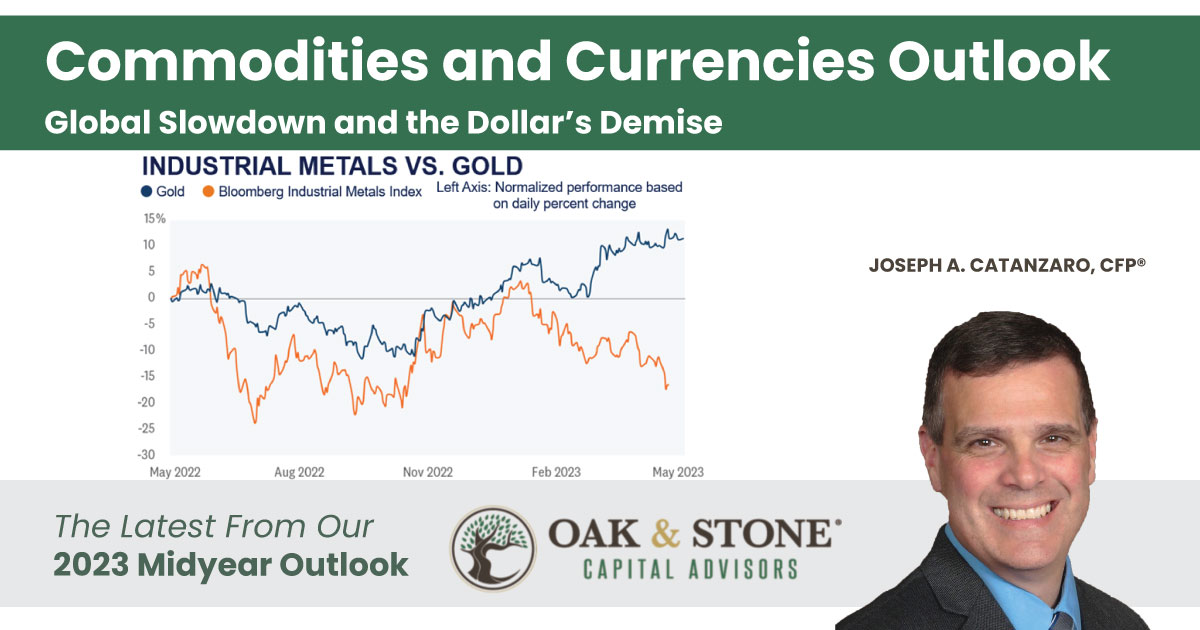

Precious metals, especially gold, have seen robust interest and higher prices [Image Below], however, as global central banks have been major buyers. The Russian Central Bank has been stockpiling gold as it transitions away from the U.S. dollar amid sanctions imposed on the country’s assets. Similarly, the People’s Bank of China has been a significant buyer of gold as China continues to diversify away from the dollar. This trend—the highest level of gold purchases since 1968—is expected to continue throughout 2023 as other smaller central banks adjust their stockpiles as the ramifications of deglobalization continues to unfold.

Currencies Outlook: Reports Of The Dollar’s Demise Are Greatly Exaggerated

The U.S. dollar, as measured against a basket of developed market currencies, has been trending steadily lower since reaching 20-year highs late last September, as the key factors that were so supportive of the strengthening dollar for much of the last two years have dissipated. With markets pricing in easing from the Fed beginning in early 2024, the dollar’s large interest-rate advantage has eroded, making the dollar a relatively less attractive destination for global capital than it was before. Foreign currency valuations have also become much more compelling for investors after reaching extremes late last year many currencies had never seen. As a result, foreign asset markets are much cheaper on a relative basis and have begun to attract more investment flows in 2023.

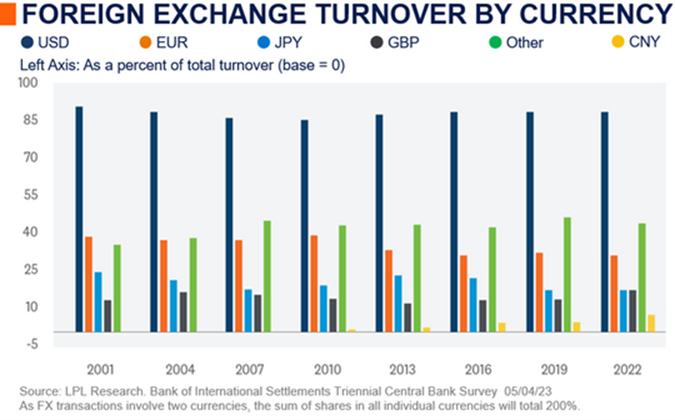

Only time will tell if the dollar is undergoing a more significant cyclical shift lower or will feel any material impact from attempts at “de-dollarization.” The large amount of dollar-denominated liabilities held outside of the U.S. (estimated at $9 trillion) is an important structural element that argues strongly against this happening in any sort of material way. The natural dollar demand this dynamic can create, particularly during times of market or geopolitical stress, is immense and can rapidly alter the currency landscape in the dollar’s favor. Global usage of the dollar is more than stable, as nearly 90% of global foreign currency transactions involve the dollar. Eroding that kind of dominance would, at best, take time. While the dollar can certainly weaken due to economic or cyclical forces, reports of the dollar’s imminent structural demise are greatly exaggerated.

ON THE GLOBAL FRONT

In Europe, economic surprises like the warmest winter on record (and avoiding an energy crisis), little escalation of the conflict in the Ukraine, and the European Central Bank’s (ECB) steady push to normalize policy were clear positives for the euro in the first half of 2023. Whether the ECB can continue to stay on this normalization path will likely determine if the euro can continue to advance. The impact of tighter monetary policy and recession risk could make this much more challenging for the ECB.

The Japanese yen was more than 40% undervalued on a purchasing power parity basis late last year. Aggressive currency intervention from the Ministry of Finance and a surprise move by the Bank of Japan (BOJ) in December to alter its Yield Curve Control (YCC) policy have helped the yen rebound from 30-year lows. Further relaxation of YCC policy in the second half of 2023 is a clear potential yen positive, but the recent change in leadership at the BOJ could see policy shifts pushed further out.