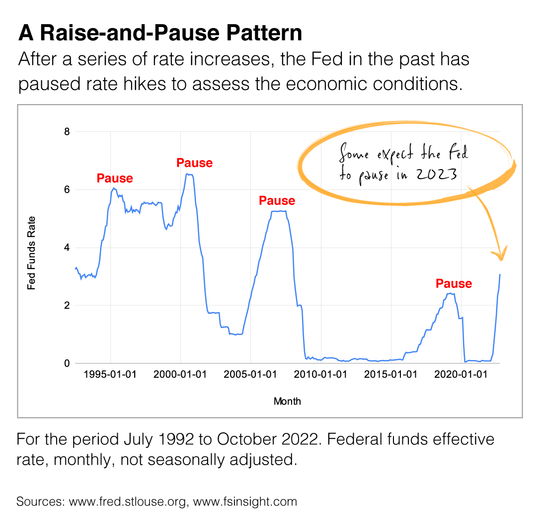

Over the years, the Fed has followed a similar pattern with interest rates. It raises interest rates, then pauses, so it can see how the economy is adjusting to the higher rates. The chart below shows the Fed’s pattern with short-term rates during the past 30 years.

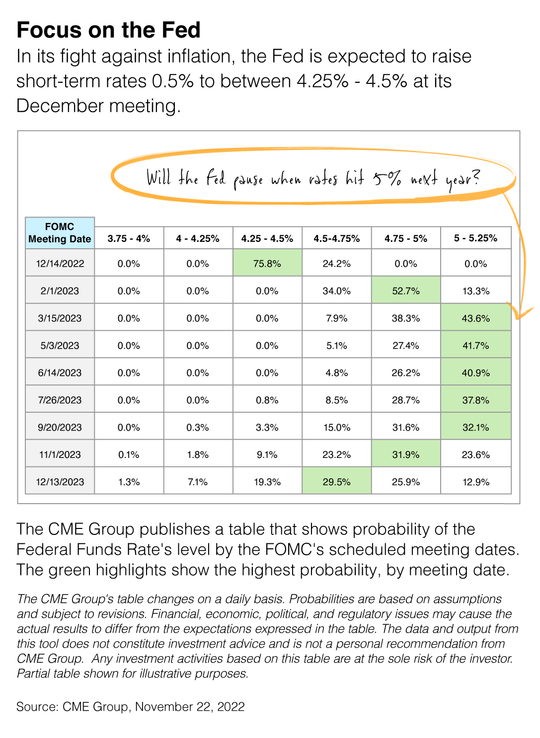

So, when will the Fed be ready to pause? In the table below, you can see that speculators are anticipating it may start as early as March 2023 when the Fed funds rate is between 5% and 5.25%.

The Federal Open Market Committee gave an update on its outlook for interest rates when it released the minutes from its November 2022 meeting.

“In addition, a substantial majority of participants judged that a slowing in the pace of (interest rate) increase(s) would likely soon be appropriate,” the Committee said. “A slower pace in these circumstances would better allow the Committee to assess progress toward its goals of maximum employment and price stability.”

It’s an encouraging update that leaves plenty of room for interpretation. But when investing, it’s best to focus on what you can control and understand that markets will fluctuate over time.